Although cash flow was poured into the market thanks to bottom-fishing demand triggered by a sharp drop in previous trading session, the Vietnam’s benchmark slumped after MSN shares unexpectedly fell by the daily limit of 7 percent as foreign investors net sold more than 1.2 million shares of MSN, or nearly VND81 billion.

MSN alone caused the VN-Index to lose 0.8 points. Ending the trading session, MSN retreated to VND64,200 per share and up to 2.27 million shares matched. Therefore, matching volume of MSN surged to the highest level in the past year since December 21 last year when 2.4 million shares of MSN were traded, worth VND190 billion. This was also the lowest price of MSN shares in the past year, a decrease of 17 percent compared to the price of VND77,500 per share at the end of last year.

The fact that foreign investors continued to net sell nearly VND230 billion in the market, mainly blue-chip stocks, of which, they sold a worth of VND80.5 billion of MSN shares and a worth of VND61 billion of VHM shares, was also the reason that dragged down the benchmark.

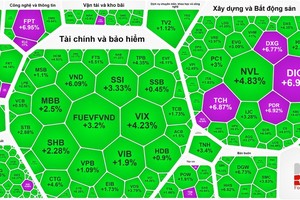

The VN-Index shrank 5.88 points, or 0.61 percent, to close at 953.43 points with 129 winners, 190 losers while 67 stocks remained unchanged.

Meanwhile, the HNX-Index of the smaller bourse in the north still gained 0.17 points, or 0.17 percent, to finish at 101.07 points with 62 stocks advancing, 73 declining and 51 standing still.

Market liquidity increased strongly with trading volume on both trading floors reaching 291 million shares, worth VND8.2 trillion, of which, put-through transactions accounted for VND4.4 trillion.

MSN alone caused the VN-Index to lose 0.8 points. Ending the trading session, MSN retreated to VND64,200 per share and up to 2.27 million shares matched. Therefore, matching volume of MSN surged to the highest level in the past year since December 21 last year when 2.4 million shares of MSN were traded, worth VND190 billion. This was also the lowest price of MSN shares in the past year, a decrease of 17 percent compared to the price of VND77,500 per share at the end of last year.

The fact that foreign investors continued to net sell nearly VND230 billion in the market, mainly blue-chip stocks, of which, they sold a worth of VND80.5 billion of MSN shares and a worth of VND61 billion of VHM shares, was also the reason that dragged down the benchmark.

The VN-Index shrank 5.88 points, or 0.61 percent, to close at 953.43 points with 129 winners, 190 losers while 67 stocks remained unchanged.

Meanwhile, the HNX-Index of the smaller bourse in the north still gained 0.17 points, or 0.17 percent, to finish at 101.07 points with 62 stocks advancing, 73 declining and 51 standing still.

Market liquidity increased strongly with trading volume on both trading floors reaching 291 million shares, worth VND8.2 trillion, of which, put-through transactions accounted for VND4.4 trillion.