Three consecutive losing sessions erased all results of 2020

Within the first 15 minutes of the trading session, the VN-Index lost more than 50 points or 4.7 percent. Even stock groups that had announced positive business results, such as banking, securities, and steel, faced strong selling pressure. All large-cap stocks, such as VCB, BID, CTG, MBB, STB, HDB, TCB, VPB, VHM, VRE, HPG, and GVR, saw abundant selling volume.

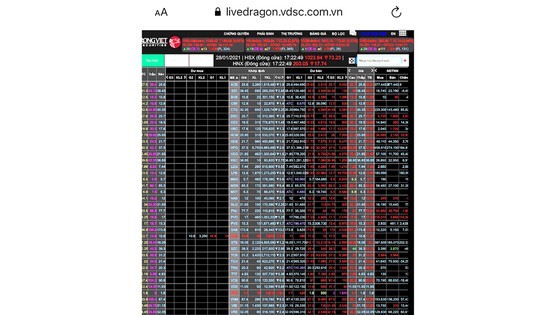

At the end of the trading session on January 28, the VN-Index plunged 73.23 points, or 6.67 percent, to 1,023.94 points, the highest drop in history. There were only 20 gainers and 12 unchanged stocks, while there were up to 478 losers. Similarly, on the Hanoi Stock Exchange, the HNX-Index also had the sharpest drop in the past 14 years (since July 2, 2007), with a decrease of 9.98 percent, or 17.74 points, to close at 203.05 points. Market liquidity was at an extremely high level, with a total trading volume of 955.5 million shares, worth VND21.04 trillion. Of which, put-through transactions accounted for more than VND2.86 trillion.

In 2020, Vietnam's stock market was considered to be one of the ten stock markets with the strongest resistance against the pandemic and best recovery in the world, and at the same time, it was among the top five fastest-growing stock markets. By the end of last year, the VN-Index reached 1,103 points. Thus, after only three recent deep declines with a total of 150 points, the VN-Index not only lost all its achievements in 2020 but also retreated to 1,000 points.

Explaining this phenomenon, the representative of TVSI Securities Company said that before a sharp sell-off in the trading session on January 28, the market had shown signs of strong selling after approaching the historic peak of 1,200 points on January 13 this year. The beginning of the correction was the trading session on January 19, in which the VN-Index lost more than 70 points. In the two trading sessions on January 26 and 27, the VN-Index also fell sharply, slashing 30-40 points per trading session. Along with that, before opening the session on January 28, the market had continuously received bad news. Specifically, the US stock market plummeted sharply because of the fear that the pandemic would continue to spread, and many enterprises announced worse business results. Closing the previous session, the Dow Jones dropped by up to 634 points or 2.1 percent. The S&P 500 index slumped 99 points or 2.6 percent. Domestically, Vietnam had new community transmission cases after 55 days without them, making investors worry that it could negatively affect production, business, and travel activities during the Lunar New Year. Besides, there were concerns about increasing pressure of mortgage lien release from securities companies, especially for investors using high margin in the previous trading sessions.

Mr. N.T.T., a big investor in Vietnam’s stock market, said that right from January 27, when the market collapsed for a second consecutive trading session, many securities companies activated sell orders to reduce the margin, including forced selling orders for several stocks. “Since the VN-Index hit 1,200 points on January 13, this year to now, the VN-Index has decreased by nearly 14.5 percent. The existing pressure of mortgage lien release is a factor leading to the recent sell-off, thereby causing the market to fall sharply,” he said.

Bubble bursting?

Vietnam's stock market, after a sharp decline to nearly 600 points in March last year, bounced back to 1,200 points at the beginning of this year with almost no corrections. Regarding the question that whether because Vietnam's stock market had increased robustly and rapidly over the past few days, so the sharp drop in the past few days is the sign of bubble bursting, many experts said that the Price to Earning ratio of the VN-Index was at nearly 20. Although the valuation is no longer cheap, it is still much lower than the average of about 26.3 of many other markets in Southeast Asia. And, it is still lower than a P/E level of 22 in 2018, when the VN-Index hit its record high of 1,200 points. Therefore, it is not the time for the stock bubble to appear.

An expert said that Vietnam's stock market recently climbed strongly, but most experienced investors, who hold lots of stocks, had taken profits earlier and made profits. Only new and inexperienced investors are likely to suffer heavy losses because they made investments when the market had already risen sharply. “However, the current correction is an opportunity for the market to purge new investors with overconfidence, as well as help the market to eliminate copycat investors who only buy when the market increases sharply. This is also the period when stocks reset a more suitable price level with stock valuation and increasing attractiveness for buying in,’ this expert said. However, he also recommended that the market may still face further downward pressure due to the biggest single-day plunge, especially in the context that the Covid-19 pandemic develops complicatedly. Therefore, this is the time for investors to manage their risks well because it is better safe than sorry.

Within the first 15 minutes of the trading session, the VN-Index lost more than 50 points or 4.7 percent. Even stock groups that had announced positive business results, such as banking, securities, and steel, faced strong selling pressure. All large-cap stocks, such as VCB, BID, CTG, MBB, STB, HDB, TCB, VPB, VHM, VRE, HPG, and GVR, saw abundant selling volume.

At the end of the trading session on January 28, the VN-Index plunged 73.23 points, or 6.67 percent, to 1,023.94 points, the highest drop in history. There were only 20 gainers and 12 unchanged stocks, while there were up to 478 losers. Similarly, on the Hanoi Stock Exchange, the HNX-Index also had the sharpest drop in the past 14 years (since July 2, 2007), with a decrease of 9.98 percent, or 17.74 points, to close at 203.05 points. Market liquidity was at an extremely high level, with a total trading volume of 955.5 million shares, worth VND21.04 trillion. Of which, put-through transactions accounted for more than VND2.86 trillion.

In 2020, Vietnam's stock market was considered to be one of the ten stock markets with the strongest resistance against the pandemic and best recovery in the world, and at the same time, it was among the top five fastest-growing stock markets. By the end of last year, the VN-Index reached 1,103 points. Thus, after only three recent deep declines with a total of 150 points, the VN-Index not only lost all its achievements in 2020 but also retreated to 1,000 points.

Explaining this phenomenon, the representative of TVSI Securities Company said that before a sharp sell-off in the trading session on January 28, the market had shown signs of strong selling after approaching the historic peak of 1,200 points on January 13 this year. The beginning of the correction was the trading session on January 19, in which the VN-Index lost more than 70 points. In the two trading sessions on January 26 and 27, the VN-Index also fell sharply, slashing 30-40 points per trading session. Along with that, before opening the session on January 28, the market had continuously received bad news. Specifically, the US stock market plummeted sharply because of the fear that the pandemic would continue to spread, and many enterprises announced worse business results. Closing the previous session, the Dow Jones dropped by up to 634 points or 2.1 percent. The S&P 500 index slumped 99 points or 2.6 percent. Domestically, Vietnam had new community transmission cases after 55 days without them, making investors worry that it could negatively affect production, business, and travel activities during the Lunar New Year. Besides, there were concerns about increasing pressure of mortgage lien release from securities companies, especially for investors using high margin in the previous trading sessions.

Mr. N.T.T., a big investor in Vietnam’s stock market, said that right from January 27, when the market collapsed for a second consecutive trading session, many securities companies activated sell orders to reduce the margin, including forced selling orders for several stocks. “Since the VN-Index hit 1,200 points on January 13, this year to now, the VN-Index has decreased by nearly 14.5 percent. The existing pressure of mortgage lien release is a factor leading to the recent sell-off, thereby causing the market to fall sharply,” he said.

Bubble bursting?

Vietnam's stock market, after a sharp decline to nearly 600 points in March last year, bounced back to 1,200 points at the beginning of this year with almost no corrections. Regarding the question that whether because Vietnam's stock market had increased robustly and rapidly over the past few days, so the sharp drop in the past few days is the sign of bubble bursting, many experts said that the Price to Earning ratio of the VN-Index was at nearly 20. Although the valuation is no longer cheap, it is still much lower than the average of about 26.3 of many other markets in Southeast Asia. And, it is still lower than a P/E level of 22 in 2018, when the VN-Index hit its record high of 1,200 points. Therefore, it is not the time for the stock bubble to appear.

An expert said that Vietnam's stock market recently climbed strongly, but most experienced investors, who hold lots of stocks, had taken profits earlier and made profits. Only new and inexperienced investors are likely to suffer heavy losses because they made investments when the market had already risen sharply. “However, the current correction is an opportunity for the market to purge new investors with overconfidence, as well as help the market to eliminate copycat investors who only buy when the market increases sharply. This is also the period when stocks reset a more suitable price level with stock valuation and increasing attractiveness for buying in,’ this expert said. However, he also recommended that the market may still face further downward pressure due to the biggest single-day plunge, especially in the context that the Covid-19 pandemic develops complicatedly. Therefore, this is the time for investors to manage their risks well because it is better safe than sorry.