The benchmark VN-Index on the HCM Stock Exchange fell 1.18 percent to close at 766.56 points, extending its fall for a second day from a loss of 0.9 percent on July 7. The benchmark index also had the worst decline since the beginning of 2017.

The HNX-Index on the Hanoi Stock Exchange lost 1.19 percent to end at 100.37 percent. The northern market index fell 1 percent on July 7.

More than 328.2 million shares were exchanged on both bourses, worth 5.26 trillion VND (233.7 million USD).

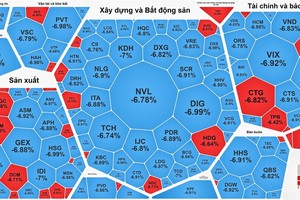

Market conditions were negative with declining stocks outnumbering gainers by 348 to 139, and 17 of the 20 sectors on the stock market ending in the negative territories.

In the VN30 Index, which tracks the movement of the 30 largest companies by market capitalisation, 28 stocks declined.

The worst decliners included Sai Gon Securities Inc (SSI), BIDV (BID), MBBank (MBB) and Vietcombank (VCB), and DHG Pharmaceutical Co (DHG).

Volatile crude prices also had negative impacts on energy stocks, pulling PetroVietnam Gas (GAS) down 0.7 percent.

According to market analysts and brokerage firms, the sharp decline came after both local indices continuously hit their fresh highs last week, allowing investors to lock in profits for their portfolios.

The VN-Index last Thursday set a nine-year high of 782.65 points and the HNX-Index climbed to 102.60 points after a seven-day rally.

Nguyen The Minh, head of the capital market analysis at Sai Gon Securities Inc, said investors thought the local indices had reached their expected profitable levels, so they simply offloaded stocks to earn some profits.

The selling also helped ease the margin lending condition on the market, he said, as money had been transferred from large-cap and mid-cap stocks to penny ones, putting the stock market at high risk of correction.

The local market was also affected by negative trends in the global markets, such as the volatility of oil prices and risks in the US market, he added.

In addition, investors started offloading stocks of companies that had been expected to release good earnings reports for the second quarter, Minh said.

They were seeking a chance to sell those stocks as they had priced in the results of those stocks in advance, especially after those companies experienced strong gains in their first-quarter earnings, Minh added.

The HNX-Index on the Hanoi Stock Exchange lost 1.19 percent to end at 100.37 percent. The northern market index fell 1 percent on July 7.

More than 328.2 million shares were exchanged on both bourses, worth 5.26 trillion VND (233.7 million USD).

Market conditions were negative with declining stocks outnumbering gainers by 348 to 139, and 17 of the 20 sectors on the stock market ending in the negative territories.

In the VN30 Index, which tracks the movement of the 30 largest companies by market capitalisation, 28 stocks declined.

The worst decliners included Sai Gon Securities Inc (SSI), BIDV (BID), MBBank (MBB) and Vietcombank (VCB), and DHG Pharmaceutical Co (DHG).

Volatile crude prices also had negative impacts on energy stocks, pulling PetroVietnam Gas (GAS) down 0.7 percent.

According to market analysts and brokerage firms, the sharp decline came after both local indices continuously hit their fresh highs last week, allowing investors to lock in profits for their portfolios.

The VN-Index last Thursday set a nine-year high of 782.65 points and the HNX-Index climbed to 102.60 points after a seven-day rally.

Nguyen The Minh, head of the capital market analysis at Sai Gon Securities Inc, said investors thought the local indices had reached their expected profitable levels, so they simply offloaded stocks to earn some profits.

The selling also helped ease the margin lending condition on the market, he said, as money had been transferred from large-cap and mid-cap stocks to penny ones, putting the stock market at high risk of correction.

The local market was also affected by negative trends in the global markets, such as the volatility of oil prices and risks in the US market, he added.

In addition, investors started offloading stocks of companies that had been expected to release good earnings reports for the second quarter, Minh said.

They were seeking a chance to sell those stocks as they had priced in the results of those stocks in advance, especially after those companies experienced strong gains in their first-quarter earnings, Minh added.